geothermal tax credit iowa

Iowa had a short term program for geothermal and the funding was depleted in short orderOther Local Incentives. When multiple housing cooperatives or horizontal property regimes incur expenses that qualify for the tax credit taxpayers owning and living in the units are treated as having made their proportionate share of any qualified geothermal property expenditures made by the cooperative or regime.

The Federal Geothermal Tax Credit Your Questions Answered

Iowa State Energy Tax Credits.

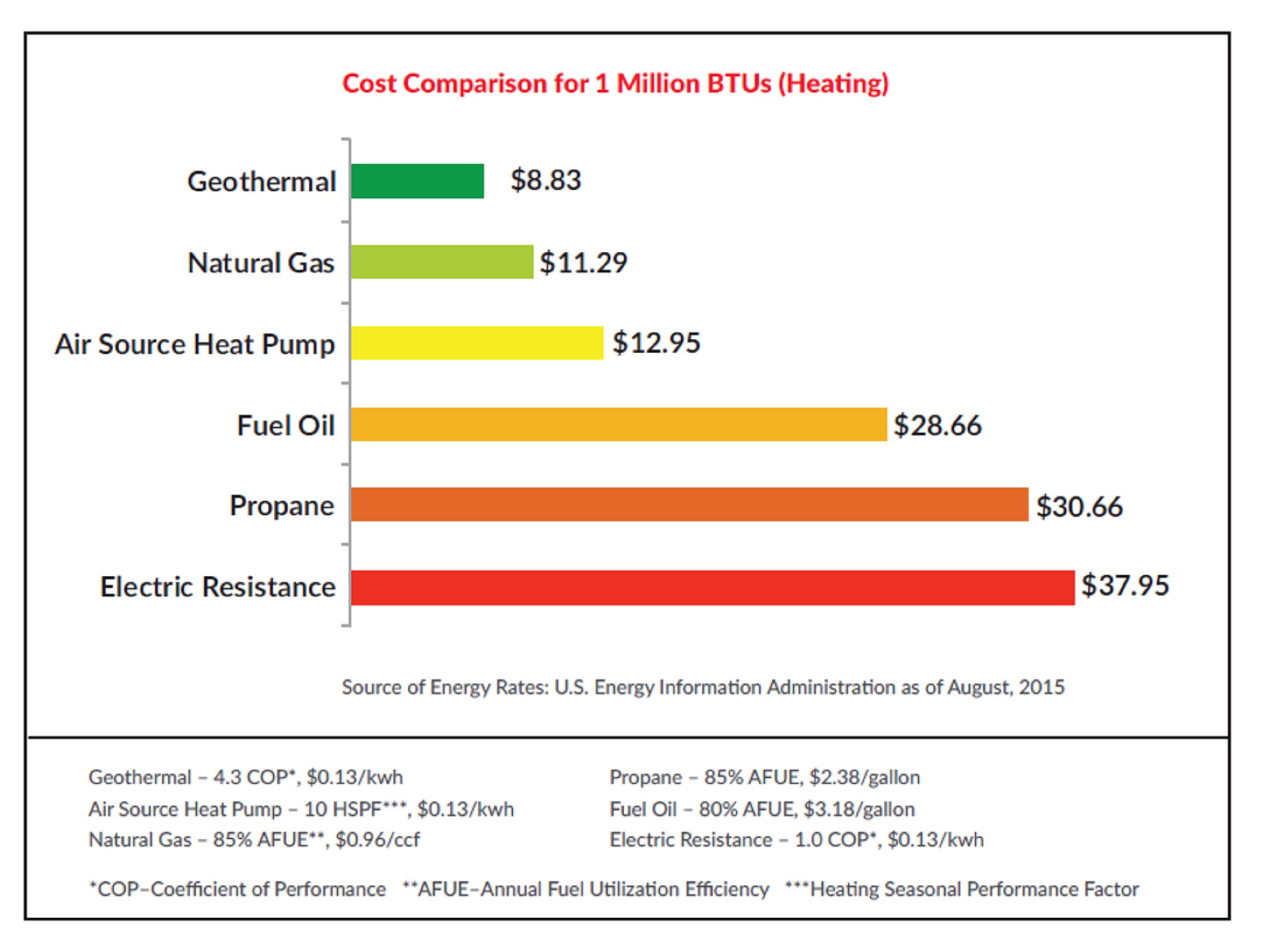

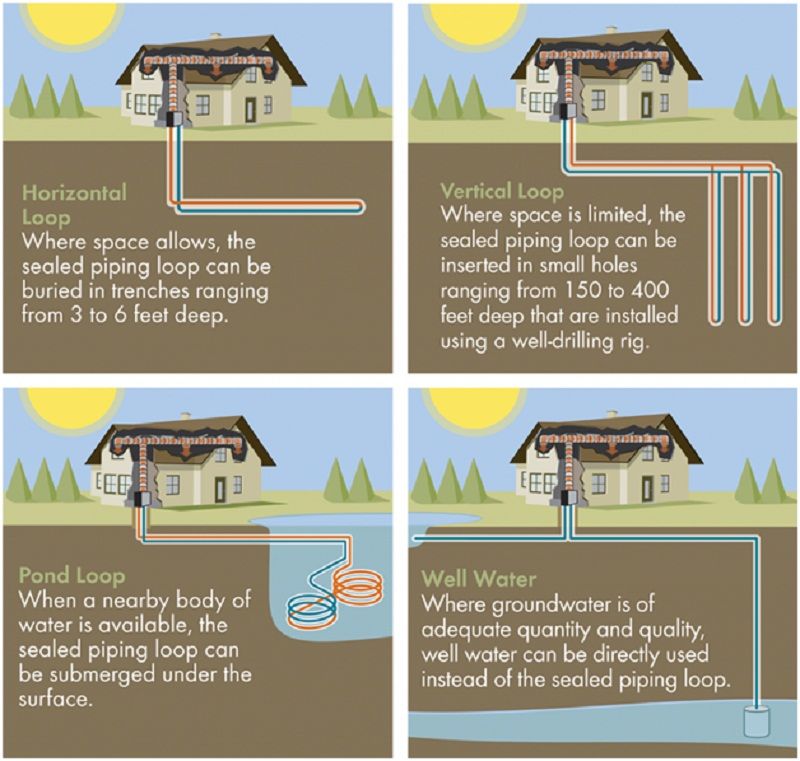

. Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential geothermal system installation costs. Geothermal Heat Pump Tax Credit 2 wwwlegisiowagov Doc ID 1231475 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2007 0 FY 2017 2185938 FY 2008 0 FY 2018 495540. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water.

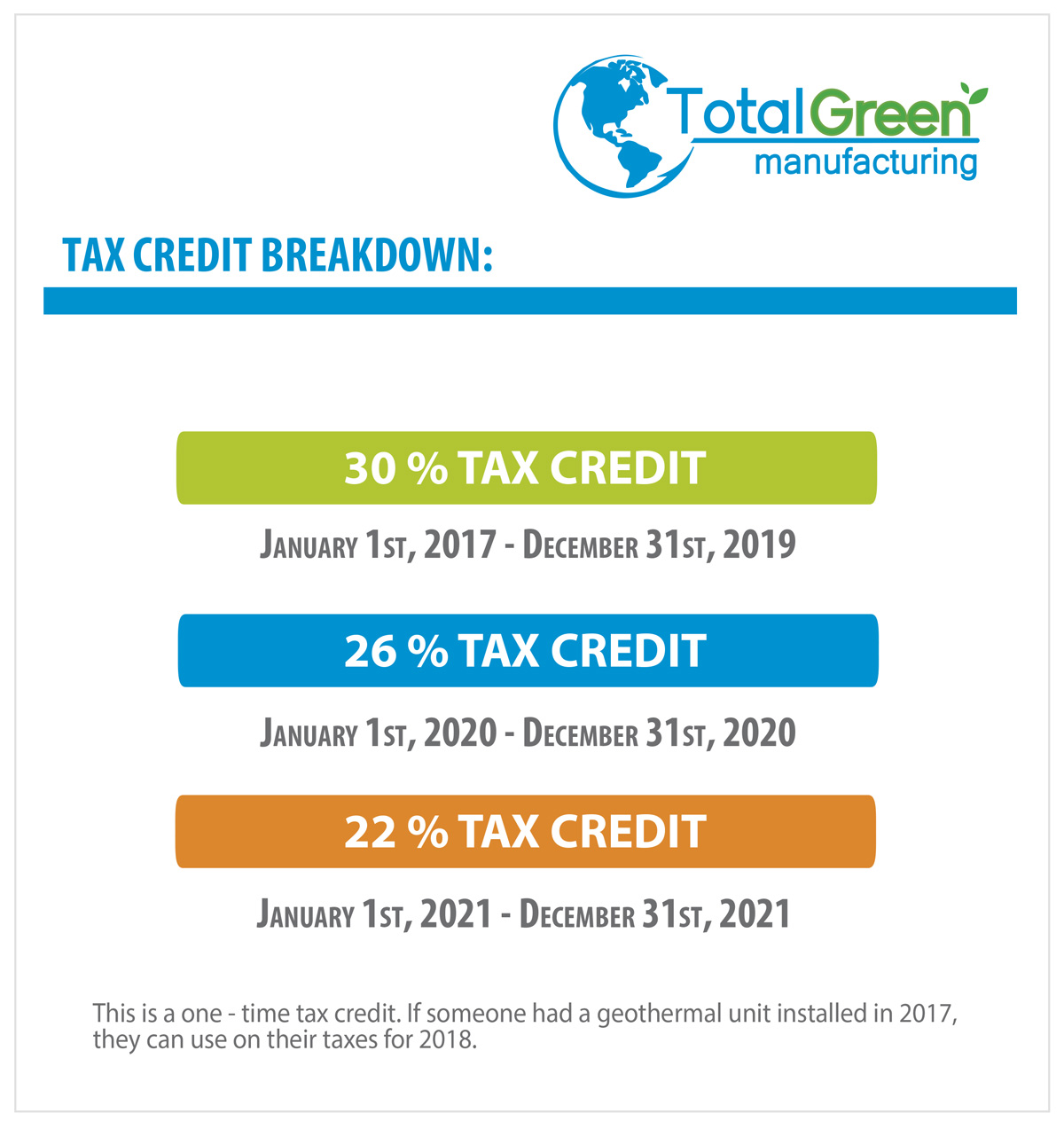

This new income tax credit replaces previous geothermal-related income tax credits that were repealed by the Iowa legislature effective in 2019. This rule making implements the Iowa geothermal heat pump income tax credit enacted in 2019 Iowa Acts House File 779 for geothermal heat pumps installed on residential property in Iowa on or after January 1 2019. Effective for installations between January 1 2012 and December 31 2016 and for installations after January 1 2019 a Geothermal Heat Pump Tax Credit is available for individual income taxpayers equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps provided in section 25Da5 of the Internal Revenue Code for.

You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022. The credit is available for units installed on or after Jan.

Add-on components like ductwork or. The Geothermal Heat Pump Tax Credit is available for qualified installations on residential property located in Iowa. Eligible for a new Iowa Geothermal Tax Credit in 2018.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Taxpayers filing a claim for the Geothermal Tax Credit must submit Form IA 140 in addition to Schedule IA 148 with the individual income tax return. The credit is available for units installed on or after Jan.

The Geothermal Tax Credit covers expenses including labor onsite preparation assembly equipment and piping or wiring to connect a system to the home. Select to learn more and to submit an application for the tax credit. The State credit equals 200 of.

1 2019 and is available for Iowa homeowners on Iowa residential properties. Available to the residentowner of an Iowa residence who installs geothermal at that residence. The federal credit is set to expire December 31 2016.

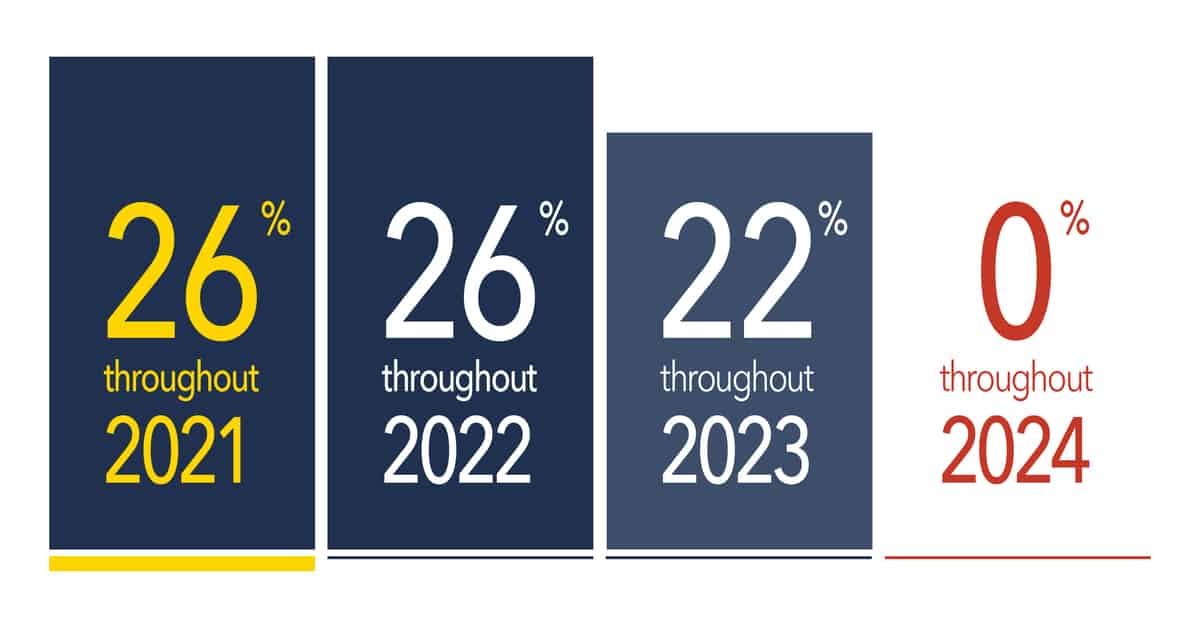

In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source. Since geothermal systems are the most efficient heating and cooling units available the United States federal government has enacted a 26 federal geothermal tax credit with no upper limit. Oversight of this tax credit was a function of Department of Revenue tax return auditing.

For geothermal heat pump units installed on or after January 1 2019. The Iowa Geothermal Tax Credit is. Geothermal heat pumps installed on residential property in Iowa are eligible for a tax credit equal to 20 of the Federal Tax CreditBecause the federal tax credit is set at 30 the state tax credit is equal to 6 of the system cost.

Geothermal Heat Pump Tax Credit. Wwwlegisiowagov Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022.

November 9 2021 Tax Credit. Bryan DeJong of Baxter Oil Company Baxter IA and Justin Larsen of Camblin Mechanical Inc Atlantic IAQuick FactsFederal Tax Credit. Geothermal heat pump tax credit no new awards beginning in 2023 Endow Iowa tax credit reduced to 100000 from 300000 per taxpayer The law also reduces the refundability of the following credits by five percent each year from 2023 through 2027 and after for a final refundability of 75 percent.

The Credit was available during calendar years CY 2017 and CY 2018 and was repealed January 1 2019. Electrical upgrades may also be eligible. Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential geothermal system installation costs.

Most local utilities offer a handsome incentive for geothermal installationHow it. In May 2012 Iowa enacted a series of tax incentives for residential geothermal incentives. Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies.

The tax credit equals 10 of the taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers dwelling or as a thermal energy sink to cool the dwelling. 1 2019 and is available for Iowa homeowners on Iowa residential properties. The credit was available during calendar years CY 2017 and CY 2018 and was repealed January 1 2019.

Iowa offers state income tax credits -- 18 of costs up to 5000. Iowa provides a geothermal heat pump tax credit the 20 credit for Iowa individual income tax liability equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps in residential property located in Iowa. Effectively a 52 percent credit based on a formula of 20 of the federal residential energy efficient property tax credit which is 26 for tax years 2020 through 2022.

The Geothermal Heat Pump Tax Credit is administered by the Iowa Department of Revenue.

10 Benefits Of Buy A Geothermal Heat Pump Rsc Blog

Geothermal Heat Pumps Western Iowa Power Cooperative

Geothermal Investment Tax Credit Extended Through 2023

Kateryna Bilonog Conducted Research On A Global Scale To Find That Government Support Is The Most Significant Fac Solar Solutions Renewable Energy Solar Energy

Savings Calculator How Much Waterless Dx Geothermal Can Save You

Iowa Bill Seeks Bigger Geothermal Heat Pump Tax Credit Geothermal Exchange Organizationgeothermal Exchange Organization

10 Benefits Of Buy A Geothermal Heat Pump Rsc Blog

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

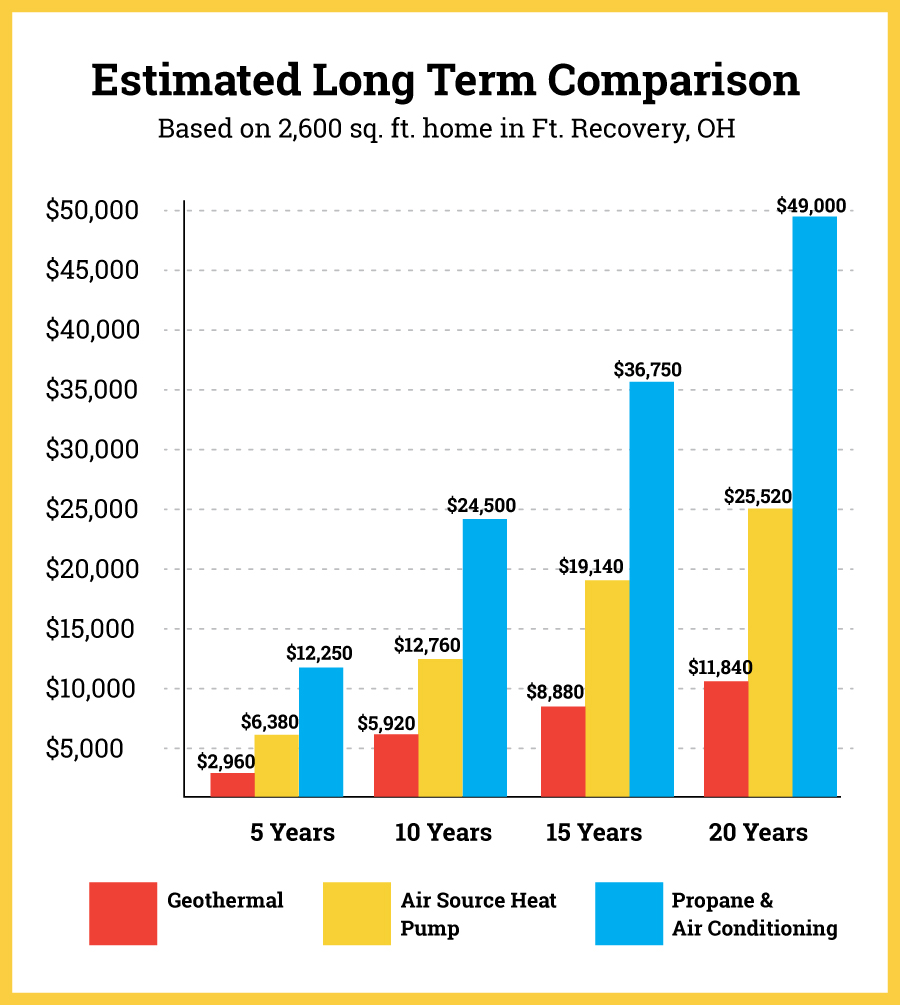

Cost Savings Comparison Buschurs Refrigeration

The Future Of Geothermal Energy A A A Impact Of Enhanced Eere

Do Geothermal Heat Pumps Raise Your Electric Bill Dandelion Energy

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

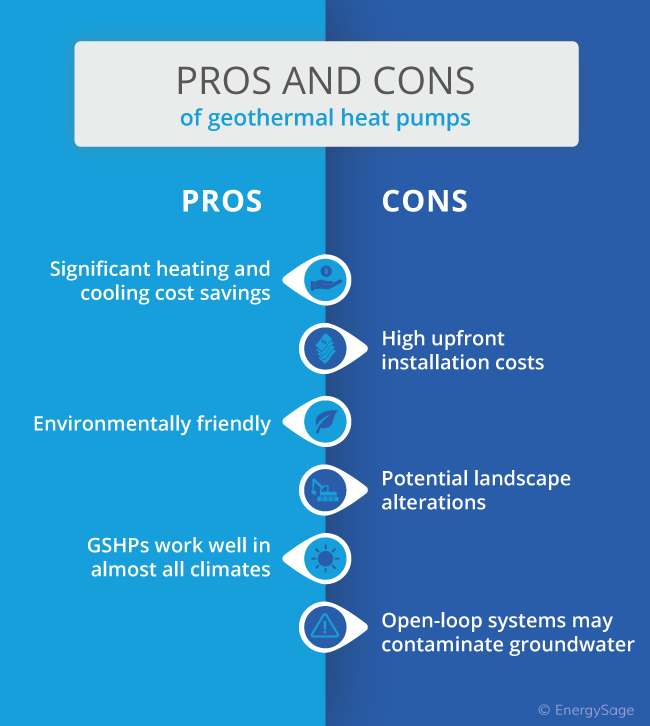

Pros And Cons Of Geothermal Heat Pumps Energysage

National Wind Resources The Bread Basket Is The Hot Spot Wind Map Wind Energy Wind

Geothermal Kits Diy Geothermal Geothermal Systems 123 Zero Energy

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac